Checking Out: Future of eCommerce Enablement

A dive into the digital economy and the emerging technologies fueling its growth.

Driven by government stimulus and brick-and-mortar closures, eCommerce growth exploded during the pandemic and through 2021. As consumers stayed glued to their couches, demand for online shopping increased for essential and non-essential goods. Companies implemented solutions - like curbside pickup and virtual styling - to reduce friction and deliver a seamless experience. Adoption for these technologies accelerated as a result, and forever changed what shoppers expect from their retail experience.

Although this growth has stabilized heading into 2023, activity is expected to remain above pre-pandemic levels and grow steadily at 5% YoY. A suddenly saturated market yields new challenges, and many independent retailers are struggling to differentiate themselves. Cart abandonment rates remain high, averaging 70% on desktop and even higher on mobile devices. And loyalty is harder to earn from brand-conscious consumers. Consumers expect retailers to play by their rules and offer personalized experiences, with little patience for anything short of that. According to Salesforce, 80% of people discard a brand after three bad experiences.

So where is the space headed now? Given that eCommerce penetration in the United States hasn’t reached 20% and lags behind China and the UK, there is still opportunity in the space. I think the future of eCommerce relies heavily on the technologies that enable it, including front-end customer conversion tools, back-end finance and analytics apps, and post-purchase support. But before we jump into that, it’s important to understand the players in the space and the key trends driving it.

The Ecosystem - SMBs and Enterprise

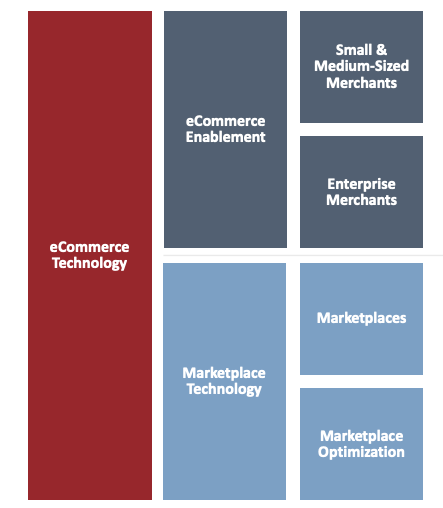

eCommerce technology can be broadly divided into two segments: enablement and marketplace. Each segment services different categories of merchants.

Enablement refers to the digital tools used to facilitate the set up of online branded stores and to manage business activities. These include eCommerce platforms, payment gateways, inventory and order management systems, reporting tools, and more. SMBs rely on eCommerce platforms (Shopify, GoDaddy, Wix, etc.) to provide an end-to-end solution for their business activities. They also connect with third party apps via APIs to provide added functionalities, allowing tech providers to scale with their merchant customers as they grow. Platforms like Shopify and Squarespace have democratized eCommerce infrastructure, empowering sellers to quickly launch D2C in a cost-effective, efficient way. This trend will continue as more custom tech stacks are enabled, which I’ll talk more about later.

Enterprise merchants, on the other hand, rely on micro-services that integrate with broader ERP systems. Best-in-class solutions are required to integrate data and operations, with Adobe, SAP, and Oracle falling in this bucket. The size of enterprise companies is partly the reason why eCommerce adoption has lagged in the sector, despite the money being there. Integrating eCommerce platforms at the enterprise level is difficult, especially at scale - large volumes of data need to be synchronized, unique workflows need to be supported, and security/compliance requirements may vary. And there’s the issue of cost - as API pricing is dependent on usage, many pricing schemes don’t make sense.

It’s also important to note that the enterprise sales cycle is different from B2C. Additional research is required, marketing channels (trade shows, professional networks, etc.) are different, and more decision makers are involved in the buying process. As such, the winners in the enablement space will be those that help automate tasks at the enterprise level and allow companies to focus on what matters most: providing excellent buyer experiences and nurturing those same relationships.

This yields opportunity for eCommerce platforms (and startups) to target this market with effective API integration at an affordable price. This would come in the form of à la carte enablement of micro-services that optimize ROI on the tech stack. The Munich based outfit, commercetools, is a good example of this - the company has raised over $300M and is backed by leading venture firms Accel and Insight Partners.

I expect this sector to grow in the coming years, as the tech stack of mid-market merchants continues to evolve and these entities grow into mature enterprise businesses. We may even see more M&A activity, as large enterprise software companies acquire eCommerce capabilities, increasing options for merchants.

Marketplaces and Optimization Technology

Marketplaces are different. Most are familiar with the big players - Etsy, Doordash, and Airbnb - which have dominated the space due to their convenience, transparency, and speed. Often vertically segmented by niche, marketplaces reduce friction and defend their market positions through strong network effects. The more homes listed on Airbnb, the higher the barriers to entry for competitors and the higher the optionality for buyers. It’s a reinforcing cycle of growth, and one of the most attractive aspects of venture investments.

These are not limited to consumer services - many B2B marketplaces already exist. They provide several advantages to businesses, giving them expanded customer reach, streamlined procurement and distribution channels, and improved pricing and transparency. This has paved the way for new industries - like manufacturing, healthcare, and agriculture - to enter the digital economy. While many of these sectors are still hampered by complex supply chains and inefficient processes, marketplace optimization tech can automate order processing, invoicing, and payments, as well as provide key data insights. There is also opportunity to offer additional services, such as trade financing or insurance.

Marketplaces have been leaders due to the massive GMV exchanging hands. But the termination of cookies, paired with changes to Apple’s privacy policy, have made it more difficult for brands and advertisers to track user behavior. As the cost of customer acquisition (CAC) goes up, first party data suddenly becomes more critical. First party data allows companies to more effectively test products, predict changes in demand, and make faster fulfillment decisions. It will be interesting to see how this impacts retailers selling through marketplaces, as the line of sight to end users is more distant.

International is the New Local

The landscape of the digital economy is changing. Amazon and Shopify continue to squeeze merchants with fees, eating into already thin margins. The economic downturn will undoubtedly impact consumers’ purchasing power and enterprise budgets. On top of that, the buyer journey has become more complex - buyers alike are discovering products and services on social media, buying goods on apps, and choosing from a myriad of payment options.

This places companies under pressure to streamline online interactions and convert clicks to sales. To win in a market where domestic and global lines are blurred, sellers need to localize experiences by region. This can be challenging, as countries have different product tastes, price sensitivities, and peak retail seasons. Merchants must also adhere to varying regulations, understand tax rules and currency conversions, and manage payment preferences. Marketing messages must also be tailored to the appropriate populations.

Furthermore, buyers are turning to social media for product discovery, shopping on mobile devices, and actively engaging with the vendors they purchase from. With changing consumer behaviors and countless data points across tech stacks, how do businesses capitalize on these trends? How do they deliver unified, personalized products and experiences across channels and touchpoints? This is where a best-in-class tech stack can provide value, which is the final topic of this piece.

Platforms: the Infrastructure

Broadly, we can divide the eCommerce tech stack into three parts: platforms, middleware, and applications. The opportunity to provide buyers with personalized, frictionless experiences has been a growth driver for all three.

Shopify, Squarespace, and Wix experienced initial success by providing merchants with easily deployable platforms, paired with standardized app integrations that accelerated time to market. But it posed challenges for merchants, especially SMBs, who wanted more flexibility with their tech stack. Platforms have adapted as a result, offering first-party apps that can be seamlessly deployed and supporting integration with many leading third-party apps. This has undoubtedly created an ecosystem of composable tools that support speed for merchants.

Headless platforms have historically supported this trend - within this architecture, the front-end and back-end are decoupled. This allows for more flexibility and customization, without the limitations of a pre-built platform. They give merchants more control over the customer journey, ensure consistent brand messaging across channels, and improve site performance with scaling advantages.

The rise in mobile shopping also bodes well for headless platforms, as they support compatibility across devices. And the omnichannel experience can be useful for businesses that want to make updates to the front-end UI without much lift on the back-end framework.

There are challenges with headless platforms, so we’ll see if this trend continues. Separating front and back-end results in longer development cycles and lead to increased costs. Technical skill sets are required to manage custom integrations, maintenance, and testing. This may not make sense for SMBs that don’t see the ROI and incremental revenue gain.

Fabric and Chord are leaders in the space, pioneering the headless approach by providing pre-built integrations with apps. Both companies are based in the United States.

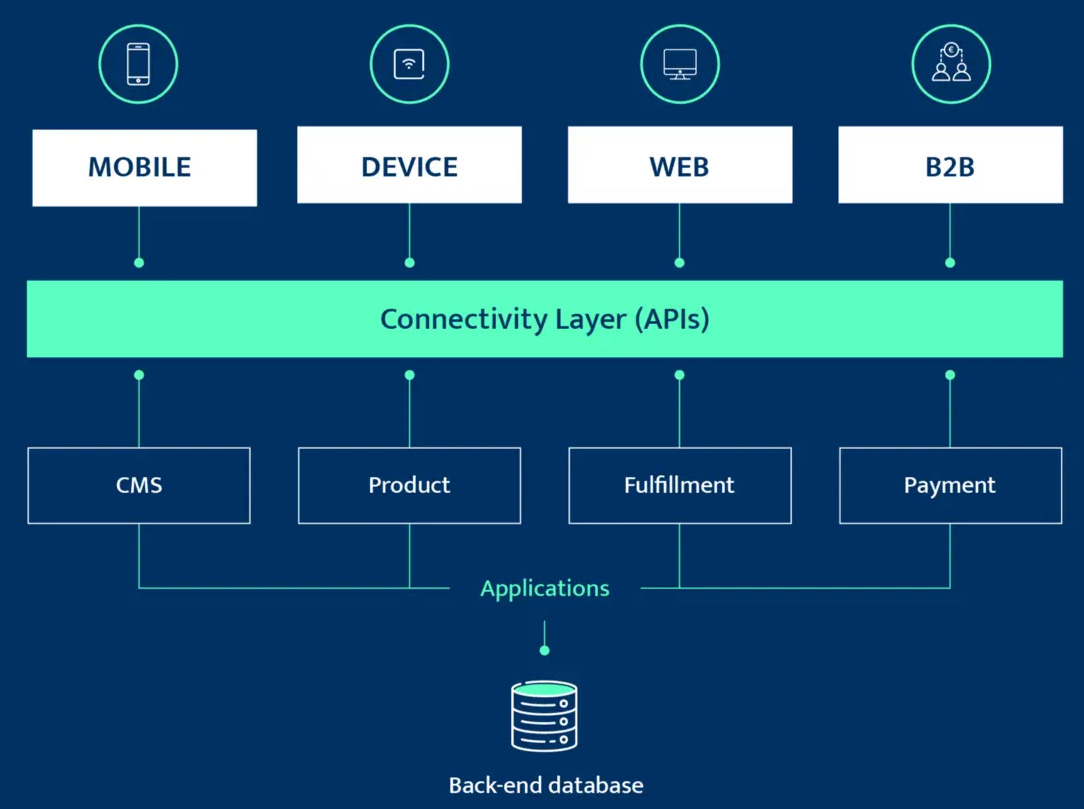

Middleware: the Connectivity Layer

Innovation in the middleware segment can be mainly attributed to Application Programming Interfaces (APIs). They enable systems and applications to communicate and share data with each other. When a buyer checks out to complete a purchase, information is sent from the front-end to the back-end via an API. Back-end applications - like payment processors, inventory management, and shipping services - can also communicate amongst each other in the same way. When a customer completes an order, inventory systems are updated to reflect stock levels and information is routed to shipping to create tracking numbers. No one does this manually.

I think this middleware category is a critical growth driver for eCommerce. The future of eCommerce is an open ecosystem, where merchants use universal APIs to integrate with any application, regardless of what platform they use. The leaders in the space, like San Francisco based startup Rutter, will make integration seamless and allow merchants to choose applications à la carte. No code needed.

Bonus points to API companies that give shops access to Fintech related services, such as FP&A, spend management, and accounting automation. Omnichannel marketplaces would fall under this category.

Applications

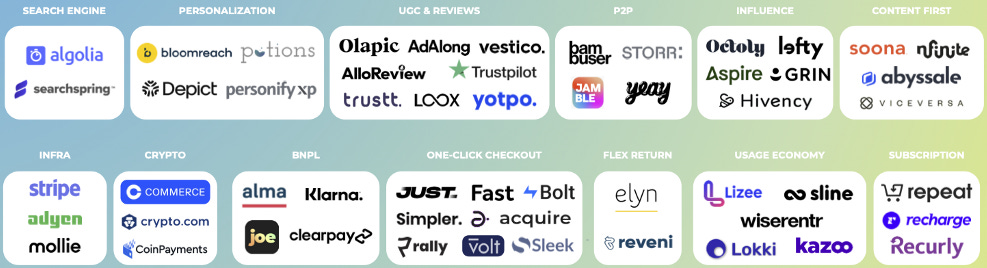

Now we get to the fun stuff. Advances at the API layer, paired with robust platform capabilities, should act as a tailwind for eCommerce applications. We will see category winners emerge, if they haven’t already, as apps diversify their revenue streams across eCommerce platforms.

In the past, I have seen startups operate like platform companies. They use a mix of earnings and debt facilities to purchase a collection of apps and roll them up into a suite offering. I don’t think this approach is wise, for the reasons I mentioned earlier. Merchants will have the capability to select the apps they feel offer the best ROI, with little patience for anything less. Therein lies the challenge, however - it may be hard for companies/apps that focus on a single value prop to achieve unicorn status, unless there is significant consolidation in the space. The market map below shows leading apps that have the potential:

Finance and Analytics

I am going to write a separate post on the future of Fintech. For now, it’s safe to assume that every consumer facing company will have Fintech components to it. Revenue-based financing has been one of those used by eCommerce brands. With RBF, lenders provide non-dilutive capital financing to online businesses in exchange for a percentage of future revenue until a certain amount is paid back. This helps businesses invest in marketing and inventory, mitigate the risk of cash flow issues, and obtain financing relatively quickly. It also aligns incentives of all parties.

At VU Venture Partners, the fund I am affiliated with, we are very excited about our portfolio company Wayflyer, which provides the same financing for online businesses fitting a certain criterion.

I think there is opportunity to provide solutions beyond capital lending, such as an all-in-one platform that mitigates foreign exchange risk, streamlines tax prep for international sales, and offers detailed analytics. Ritmo is a good example of this.

Customer Acquisition and Conversion

I talked about the impact to CAC stemming from changes to Apple privacy rules and the end of third-party cookies. As a result, eCommerce players will look for alternative ways to engage and strengthen their relationships with customers. This may come in the form of community-led growth and user generated content (UGC), which far exceeds the affiliate marketing model.

In my State of the Consumer post, I mentioned that consumers are interacting more actively with the brands they purchase from. Instead of spraying Facebook/Google ads, companies will engage product ambassadors and influencers to build movements around their brands across all channels (social media included). UGC increases customer loyalty, builds transparency through product reviews, and reduces the cost of customer support. It may also increase adoption for peer-to-peer livestream shopping, which has lagged in the USA compared to China. Storr is one of my startups operating in this niche, and has helped merchants greatly reduce their CAC.

Personalization has also been a key driver for building a digital brand, and that won’t change. Artificial Intelligence and Machine Learning can analyze customer data and shopping patterns to suggest products that most likely resonate with them. Other startups like 3DLook offer virtual try ons and sizing recommendations before checking out. I am particularly interested in those that leverage AI/ML for dynamic pricing, where product costs are personalized for the user to drive conversions.

Once shoppers reach your landing page, converting them is equally as important. Customers are demanding more flexible options - BNPL, subscriptions, one click checkout - especially during economic downturn. Payment options will continue to advance in order to boost sales, reduce cart abandonment rates, and increase AOV.

As embedded Fintech becomes common and tech stacks evolve in complexity, cybersecurity becomes more important. Merchants will require data security tools, KYC, and card protection methods to ensure buyer data remains secure and private - that is why I am bullish on vertical eCommerce security solutions. A personalized, authentic customer experience means nothing without the safety that encompasses it.

The Post-Sale Process and Maximizing LTV

So you closed the sale with a shopper, now what? In a world where brands struggle to differentiate themselves, the post sale process can be critical for securing customer loyalty. Decisions are often made to minimize CAC, but equal focus should be placed on maximizing customer lifetime value (LTV) from existing relationships. Retention is the most important metric of 2023, and most likely the year after that.

On the supply chain side, return management software (RMS) can help brands increase LTV and margins. RMS systems act as the middle software layer between customers and merchants - they automate many of the tasks involved in managing returns, including generating return labels, tracking shipments, processing refunds or exchanges, and providing insights and analytics into returns data.

RMS systems can provide transparency in the returns process with easy to use interfaces, alleviating the stress that buyers may get post purchase. They can also drive revenue growth by offering product exchanges, and reduce costs normally incurred with administration tasks. Most RMS systems are tailored to SMB merchants, creating opportunity for solutions to cater to Enterprise clients or to handle large non-standard product sizes.

There are certainly other limitations in the post-sale experience. Loyalty programs are outdated, referral programs lack insight, and customer support is known to drive buyers mad. As more commerce activity happens through social media, retailers will place more value on social listening tools that help them iterate off market feedback.

I’m excited to see the progress made by startups in these areas, specifically mentionme and gorgias. Automation and analytics can be implemented at every step of the customer journey, and will continue to be relevant as the eCommerce market grows. I expect to see more sophisticated players emerge, providing new opportunities for merchants to differentiate themselves, convert eyeballs to sales, and build lasting brands. If you’re building in this space, please reach out.

Cheers for reading.