State of the Consumer

How the pandemic and economic downturn have shifted consumer preferences, spending and working habits, and their connections with brands.

The pandemic has disrupted nearly every aspect of our lives, including the way we work and consume goods and services. With widespread job loss and economic uncertainty, consumers are tightening their budgets and rethinking their purchasing habits. This shift in behavior has created a new landscape for businesses and marketers, as they try to understand the changing needs and preferences of a more brand-conscious consumer. Let’s explore the impact of the pandemic and economic downturn on consumer behavior, and what it means for the future of retail and marketing.

The Creator Economy

The growth and mainstream adoption of the creator economy will continue, resulting in a larger and more diverse content pool. Automation tools and AI will become fundamental in creating content, allowing individuals to streamline workflows and optimize production. This will coincide with a rise in collaboration and community-building among creators, as cross-promotion will become a way to amplify reach and engage with audiences. It's critical for brands to partner with these creators and tap into social trends.

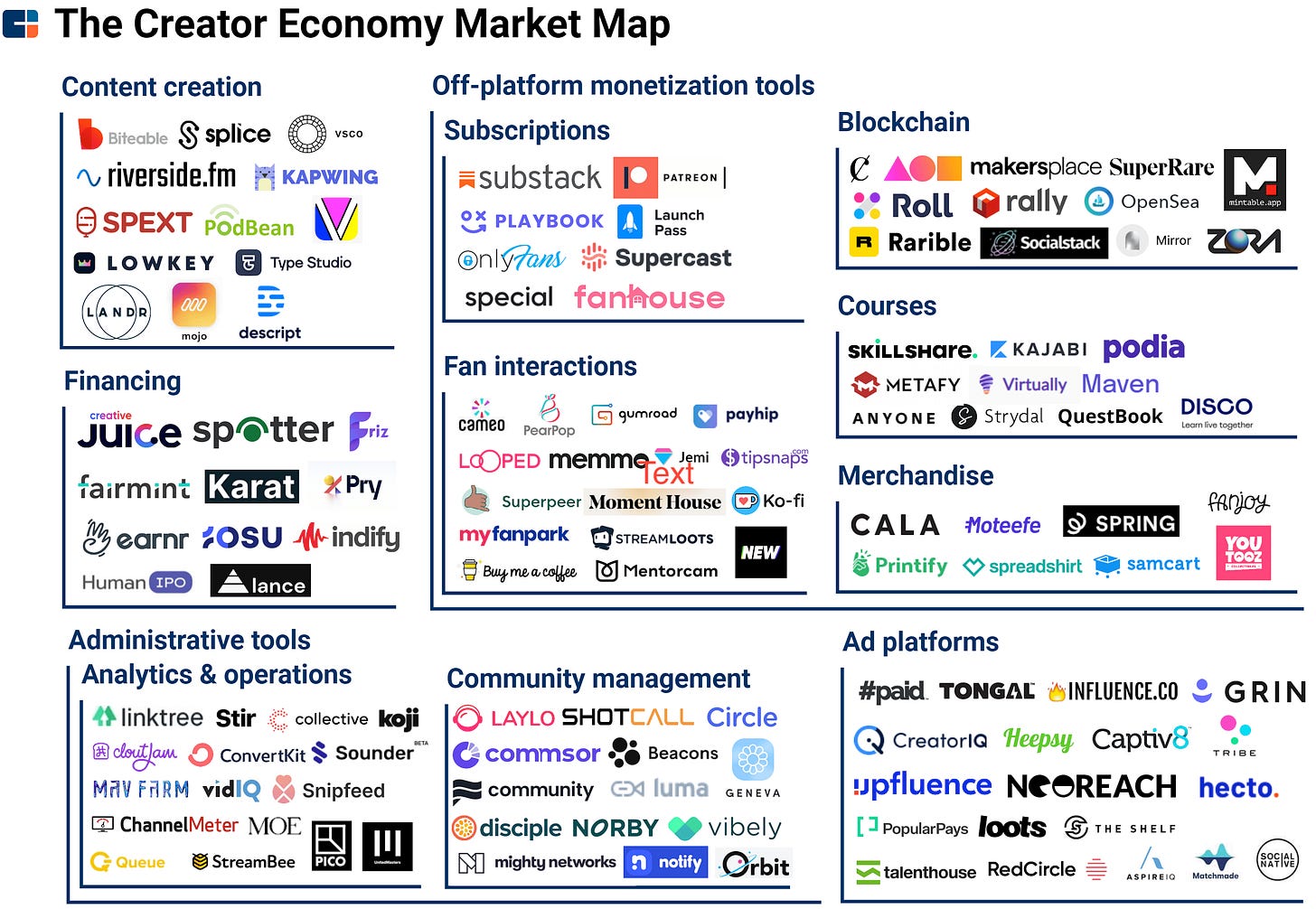

New platforms and markets will be needed to support this shift. The creator economy will expand beyond traditional social media and into new areas such as audio and virtual reality, providing new opportunities for people to reach and engage with their audiences. This is where the opportunity may lie in web3 and consumer tech/wearables, albeit this space has slowed down in funding. Let’s not forget startups operating in digital courses, merchandise, and fan connectivity - just take a look at the market map below:

With new markets comes new revenue streams. In addition to traditional monetization methods like advertising and sponsorships, creators will explore alternative sources of income such as subscription models and crowdfunding. This will be made possible by the personal connection that is established with fans and - in an extreme way - may undercut traditional advertising. The path to building a lasting brand has changed in many ways, as consumers will cut through the noise and purchase from the brands they connect with the most.

Social Commerce & New Ways of Buying

Following in China's footsteps, social and video commerce will become major trends in 2023. Consumers will increasingly adopt social platforms as a place for product discovery, a trend that aligns with the creator economy. Personalized connections will be top of mind for the average shopper, and video is a great way to showcase product benefits. I expect to see platforms support this shift by easing the friction between initial thought, add to cart, and check out. Twitter has considered enabling fiat payments through its mobile app, and TikTok has already established a marketplace for shopping. With so many eyeballs on these platforms, and given that total internet time is capped, companies not selling products through social media will get left behind.

With new trends comes new technology. Consumers favor convenience and tools that cater to their ever-changing needs. Virtual reality dressing rooms can recommend items in a person's exact size and preference. Digital payment methods can connect to POS systems and offer speed and security when checking out. AI/ML tools can personalize product recommendations as they learn over time. These technologies help businesses by providing insights into customer data, which is especially important given the anti-tracking software updates from Apple and the end of third-party cookies. Big data will be critical for companies weathering the economic downturn, forecasting their financial health, and managing seasonal inventory. Bonus points to companies that enable sellers to access alternative sources of inventory (resales, overstock/returns, etc.).

Weakened Purchasing Power & Shift in Focus

As of February, rising rates and credit card debt have not hampered consumers' willingness to spend. This cannot last, as disposable income will decrease for the average individual if wages can't keep up. Consumer preferences will shift from wants to needs, and budgeting may become top of mind. Brands can take advantage of this by offering flexible payment options, quality reward programs, and enticing perks. These actions can help alleviate cost pressures on consumers and help companies retain market share from discount stores.

Consumers will demand more control over their spending in 2023, partly due to budgetary constraints but also information fatigue. Premium products must reflect significant value for traction to occur, so companies should pay attention to customer feedback through social listening and product iteration.

New Labor Marketplaces

The pandemic sparked a massive shift in workforce dynamics, as seen by the "Great Resignation" and the "Quiet Quit". Unemployment data does not paint the entire picture, as the labor participation rate remains stubbornly low and the gig economy appears poised for growth. Many industries relying on legacy tech and outdated systems - healthcare, construction, education, and hospitality - are experiencing a historic labor shortage. These factors, coupled with recent mass layoffs, pose massive opportunities for startups to change the way firms hire and keep talent.

Companies like Upwork and Fiverr have altered the freelance economy, while TaskRabbit caters to the home services space. But opportunities remain in blue-collar jobs, rentals, short-term travel, and manufacturing.

Sustainability & Social Values

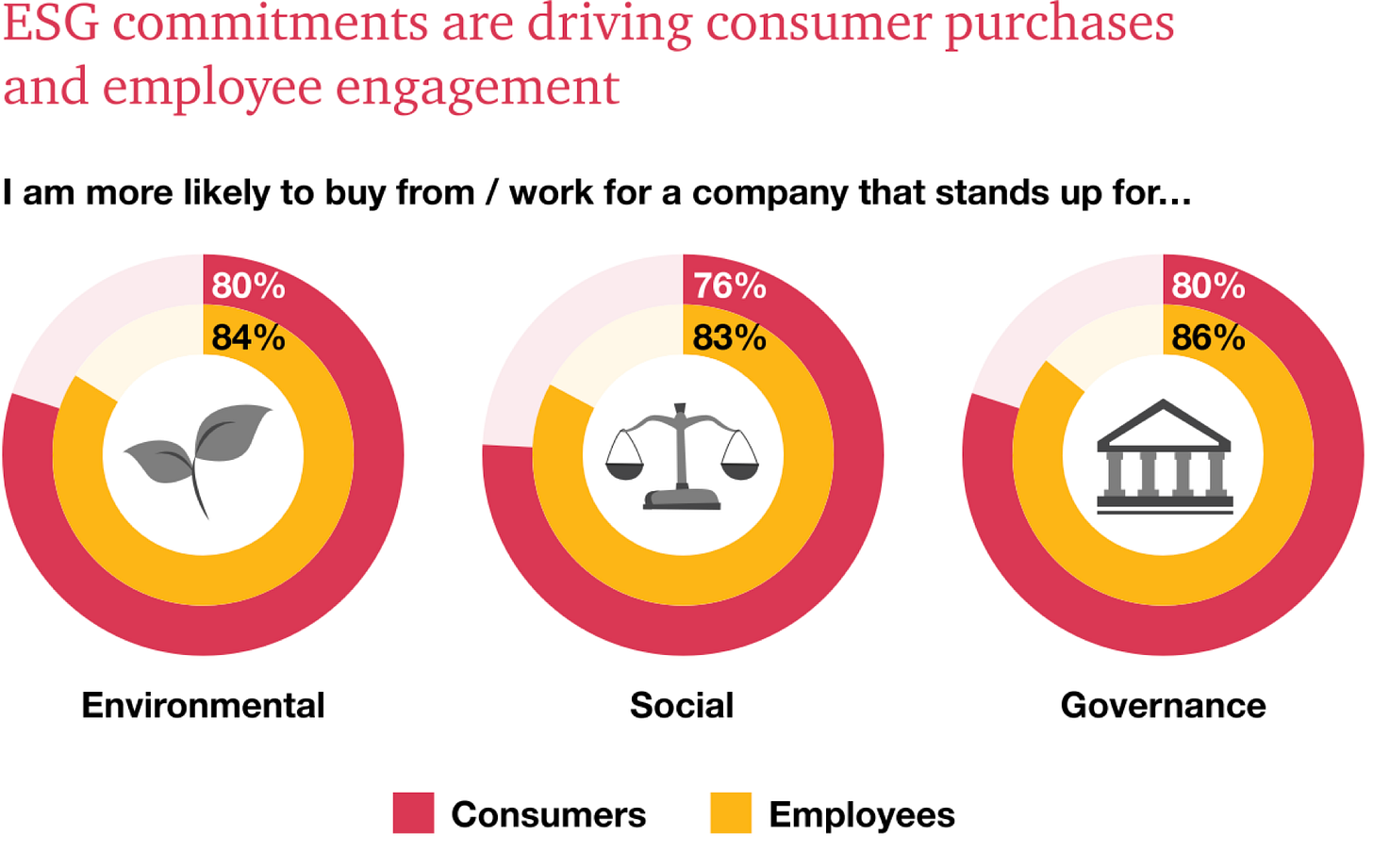

Brand-conscious consumers, particularly Gen Z, are not shy from voicing their opinions and shared values. In many ways, this makes them immune to traditional marketing tactics. Purchase decisions will be driven based on brands' social and political beliefs, so it's critical that companies align their values with the consumer. This means pursuing other socially relevant goals, such as diversity, equality, and fair working conditions. Consumers will increasingly look for companies to prove their claims around product efficacy, and we may see experts - doctors, psychologists, and chemists - play a larger role in product discovery.

Sustainability remains a key ingredient. Gen Z shoppers consider brand's environmental footprint when making buying decisions, and are even willing to pay more for green products. This bodes massive opportunity to build awareness and acquire customers by making greener choices in production. Brands can take action by using eco-friendly packaging, sustainable materials, and renewable energy sources in the manufacturing process. Or by improving transportation plans and recycling methods during distribution. There is great potential for startups operating in the food waste or recycled materials space. A survey conducted by PwC outlines things to watch for:

These trends are not limited to shopping and commerce - employers will need to share these values during the hiring process and throughout their employees' tenure. Companies that align these areas with their mission will attract the best talent. Expect corporations to implement programs around mental health, sustainability, and diversity and inclusion. There's opportunity for startups to find product-market fit here.

New Distribution Channels

Given the looming recession, many consumer-facing companies will slash budgets and marketing spend. The economic backdrop, coupled with increased costs of Facebook/Google ads, may lead brands to find new ways of acquiring customers. This can come in the form of B2B partnerships, which help drive awareness and keep customer acquisition cost (CAC) low. B2B distribution allows companies to reach customers through organic traffic, create predictable set pricing, and increase margins. Expect to see more brands participating in shopping events like Walmart and Amazon Prime Day to boost sales and offload inventory.

E-commerce shows no signs of slowing down, but storefronts are also increasing in popularity as shoppers head back out into the world. We can see this with mall loans, lack of bankruptcies, and surprising resiliency in the space. Brand-conscious individuals require several different touch points throughout the customer lifecycle. And with the high costs of digital ads mentioned above, having a brick-and-mortar footprint may actually save companies money and drive increased conversion rates and AOVs.

Takeaways

The consumer landscape has created both challenges and opportunities for businesses. As individuals become more brand-conscious and prioritize their spending, companies must adapt to meet changing needs and behaviors. This means rethinking their marketing strategies, addressing social values, or utilizing new distribution channels. The brands and companies that are able to understand and respond to these trends will be well positioned for success through 2023.

Cheers for reading.