Capital is no longer free. After years of near-zero interest rates and strong economic activity, the downturn is here. Recovery from the COVID-19 pandemic, fueled by government stimulus and pent up consumer demand, has resulted in a period of record inflation.

Some may say Jerome Powell and the Federal Reserve were late to react to rising prices, and their bonanza of seven straight rate hikes this past year caused markets to bottom out. Others may put blame on the Biden Administration, and cite that a third round of stimulus was not necessary. But does it ultimately matter? Never in the modern area have we had a CPI print above 5% that didn’t require a subsequent raise of the federal funds rate to the same level. This was bound to happen - we just weren’t ready for it.

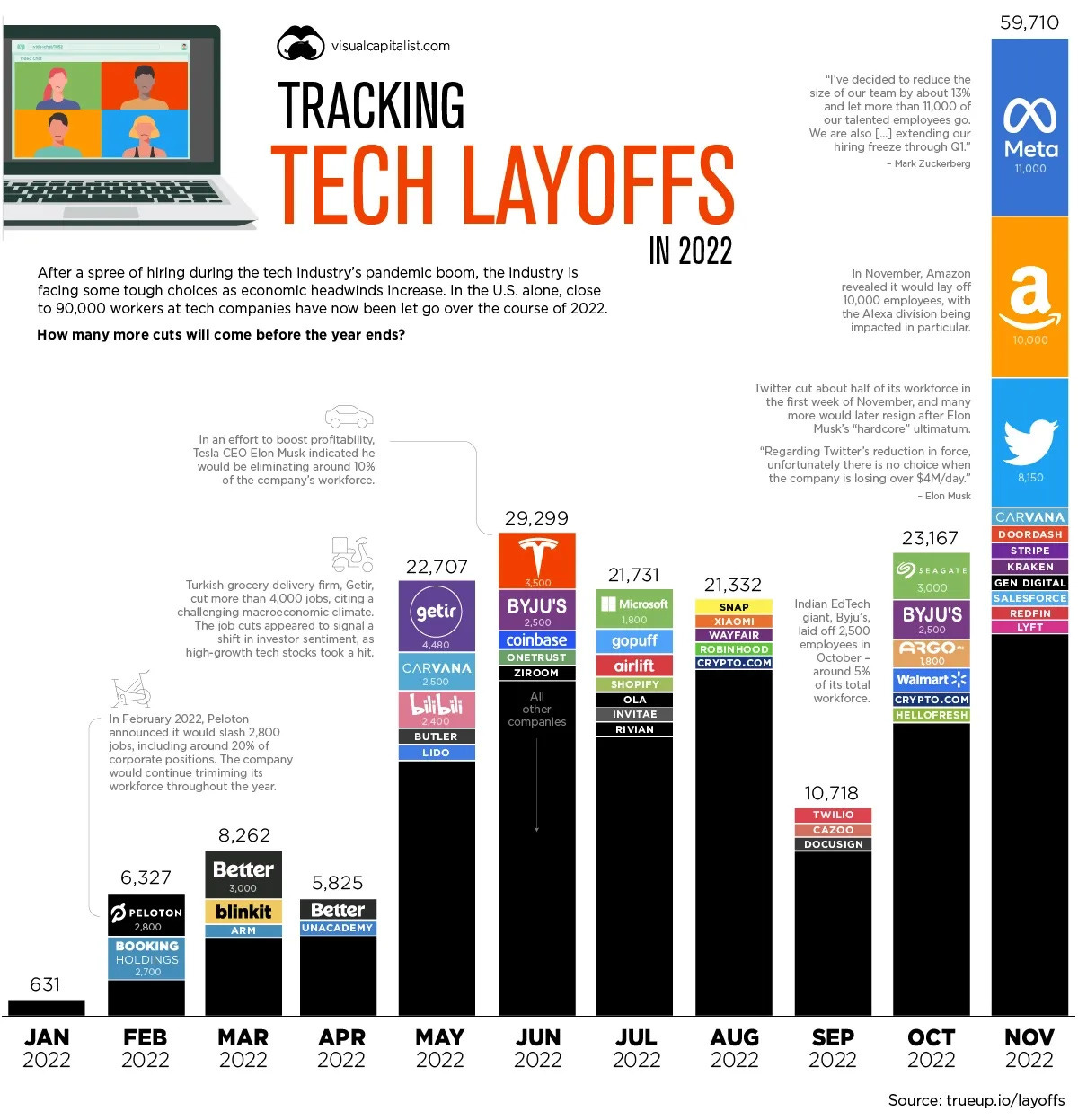

Companies over hired and over estimated growth. The rise in e-commerce activity, digital productivity, and other pandemic-induced factors led many firms to hire freely and have little to no regard for operating expenses. As harsh as it may be, companies can be operated in a much leaner manner - Elon Musk showed us that as soon as he arrived at Twitter HQ.

As such, layoffs have ensued at public companies and startups. Big banks haven't fared much better, as deal making and IPO activity have sputtered. Unfortunately, it’s the hard-working individuals that bear the brunt of this downturn. Just take a look at the chart below:

Unfortunately, I think we’ll see a third spike in layoffs during the first half of 2023. With so much talent on the sidelines, it will be interesting to see where it trickles to next. Climate tech - backed by the Inflation Reduction Act and billions of dollars in subsidies - is a very promising sector. Or maybe Web3, as long as regulation is around to define the framework and weed out the bad actors.

The market has had a difficult time adjusting to this landscape, with the S&P 500 down nearly 20% in 2022. Even the traditionally “safe” 60/40 stock bond portfolios weren’t spared, with that strategy down more than 16%.

What makes this an unprecedented situation is that the labor market remains stubbornly tight, which makes the Fed’s job difficult as they attempt to avoid a "hard landing" through quantitative tightening. The number of openings to people looking for jobs was 3:1 at one point, a number significantly fueled by the rise in the gig economy and the Great Resignation. The most recent jobs report has provided some relief, however, as December wage growth was not as high as the Street expected.

The Russia-Ukraine War has not helped matters, placing further strain on the global supply chain. The rise in prices for commodities - including energy, crops, and fertilizer - has placed more upwards pressure on CPI. I expect to see a shift in the global supply chain moving forward, as countries reduce their international dependency on things like energy, food, and semis.

Impact on Venture Capital and Private Equity

Startups will need to operate more efficiently, as capital will no longer flow from venture firms in large droves. Founders should reduce their burn rate and ensure they have enough cash runway to last through the next 6 quarters. Companies that have positive unit economics, strong product-market fit, and good leadership will prevail over those that don't. Growth will have to come at a reasonable price, and the road to profitability should be clear. In all honesty, this may be a good thing for the industry.

Given the amount of dry powder available, I still project deal activity from early-stage VCs. However they will be much more selective on which startups they back, as we have already seen. Per CB Insights, US venture funding hit nearly $200B in 2022, down 37% from 2021. Births of unicorns, or startups over $1B in valuation, sunk to 19 in Q4 2022 - this was an 86% drop compared to Q4 2021.

With higher interest rates, companies with zero profits or slow growth have been punished. Given these depressed valuations, however, the late stage buyout market may become a feeding ground for private equity firms. This is especially true for B2B SaaS companies that have strong margins and predictable revenue. Although buyout firms will need to be more selective on their investments due to the increased cost of servicing debt, these firms are great candidates due to their ability to generate cash flow based on ARR. Just look at private equity giant Thoma Bravo - the investor has already made nine acquisitions in 2022 including Coupa ($8B), Ping Identity ($2.8B), Anaplan ($10B), and more.

In summary, $25M seed rounds are a thing of the past, and founders should expect to see flat or down rounds in order to stay alive. Absurd valuation multiples of 50-100x revenue will not be seen for some time. And if founders don’t get used to the new norm, they might just become fire sale lunch for private equity shops.

Surviving is everything in 2023... and most likely the year after that.

Cheers for reading.